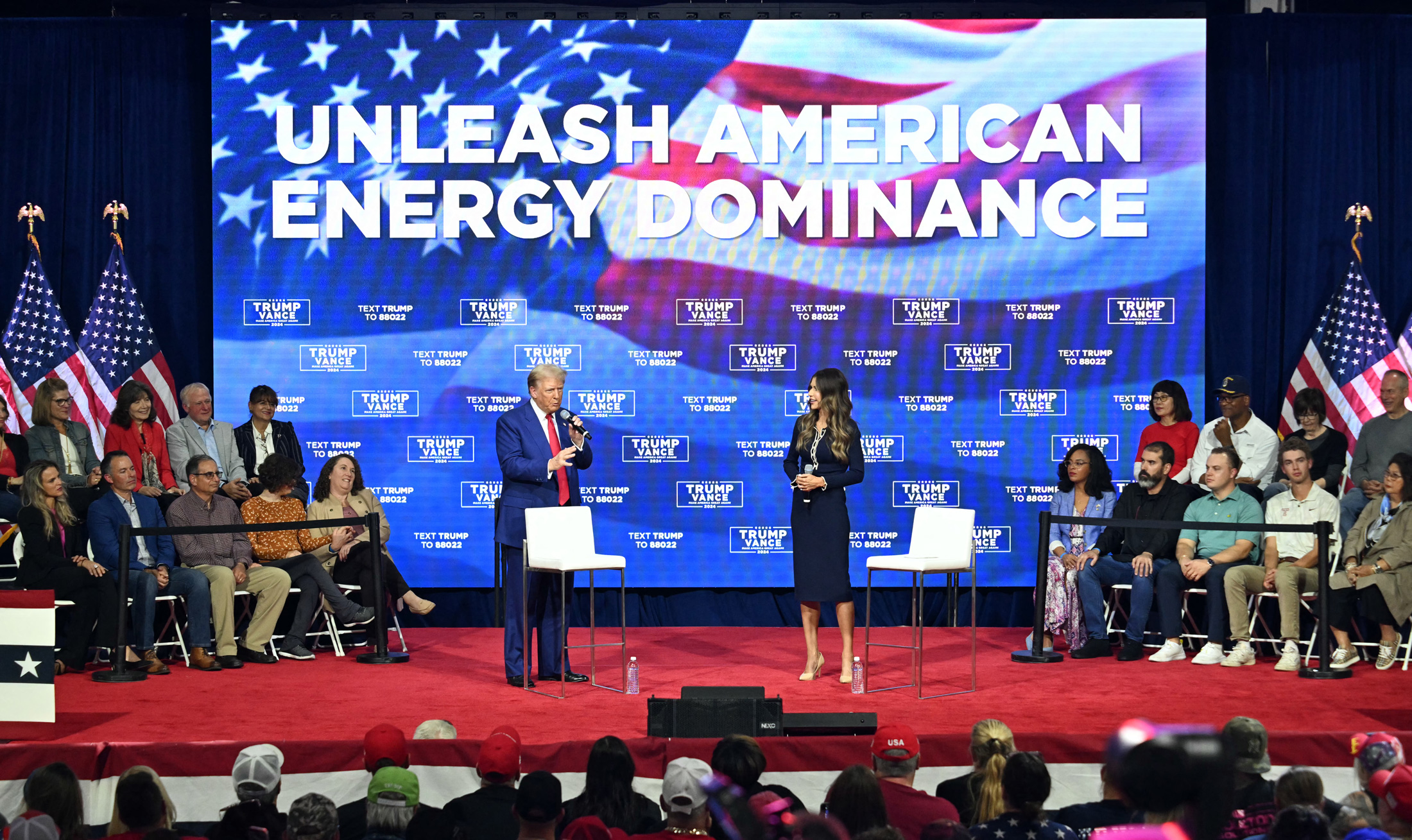

Amidst a political landscape often characterized by shifting priorities and disruptive pronouncements, former President Donald Trump’s consistent pursuit of "energy dominance" stands out as a defining feature of his economic and environmental agenda. While the term itself is a rhetorical rebrand, designed to project an image of robust national power, it echoes the long-standing bipartisan objective of "energy independence" that has shaped U.S. policy for decades. This desire to produce the nation’s energy domestically, thereby reducing reliance on potentially volatile foreign sources, gained prominence during the Nixon administration, following the geopolitical tensions and supply shocks of the 1970s oil crises. Subsequent administrations, regardless of party affiliation, have embraced this strategic imperative, albeit with varying approaches.

From President Jimmy Carter, who championed energy conservation and nascent renewable technologies in the face of the era’s energy crunch, to Presidents Obama and Biden, who advocated for a diversified "all-of-the-above" strategy that increasingly incorporated clean energy, the pursuit of energy self-sufficiency has been a consistent thread. What uniquely distinguishes the Trump administration’s iteration, despite its aggressive "Drill, Baby, Drill," "Mine, Baby, Mine," and "Beautiful Clean Coal" rhetoric, along with a flurry of regulatory rollbacks and emergency orders, is the paradox that its policies have arguably weakened, rather than strengthened, the domestic energy industry. Far from fostering dominance or abundance, these actions have inadvertently diminished the nation’s capacity to reliably generate the power essential for modern society.

A truly strategic energy policy, even one driven solely by nationalistic aims and unburdened by environmental concerns, would logically harness all available and most effective energy sources. This "all-of-the-above" approach, favored by many previous administrations, would include the rapidly expanding sectors of wind and solar power, bolstered by advanced battery storage, alongside established sources like nuclear, geothermal, hydropower, and natural gas. These diverse elements collectively enhance grid resilience, ensure supply stability, and contribute to overall energy security. However, the Trump administration’s actions have starkly diverged from this pragmatic path, effectively sidelining the most promising and cost-effective modern energy technologies.

Specific policy decisions have actively undermined the growth of clean energy. The elimination of federal tax credits for wind power and both rooftop and utility-scale solar projects dealt a significant blow to their financial viability. New wind projects on federal lands and in federal waters faced explicit closures, while proposed utility-scale solar installations on federal land were subjected to heightened scrutiny and cumbersome bureaucratic processes. The cancellation of the "Solar for All" program, designed to extend clean energy access and promote energy self-reliance among lower-income families, further illustrates this systemic discouragement. More recently, the administration clawed back over $7 billion in Biden-era funding allocated for critical clean energy and grid-reliability initiatives, many of which were slated for Western states and all of which originated from states that leaned Democratic in the 2024 election cycle, suggesting a partisan motivation behind these strategic reversals.

Concurrently, the administration has vigorously attempted to prop up the aging infrastructure and declining market share of fossil fuels, positioning them as the primary drivers of its energy agenda. This strategy, however, often overlooks the profound shifts occurring in global energy markets and the economic realities faced by these legacy industries. Plans included allocating approximately $625 million in direct subsidies to revitalize the struggling coal industry, coupled with the rollback of numerous environmental regulations—a de facto subsidy that reduces operational costs for coal-fired power plants. Furthermore, the administration opened up 13 million acres of public land across the Western United States to new coal leasing, specifically overturning Biden-era bans in the vast Powder River Basin of Wyoming and Montana, a region historically rich in coal reserves. This aggressive push for coal, however, was paradoxically coupled with the inexplicable cancellation of funding for carbon capture projects, technologies explicitly aimed at extending the operational life of existing coal plants by mitigating their carbon emissions.

These efforts to reanimate the coal industry have, thus far, yielded limited success in the marketplace. Earlier this month, the Bureau of Land Management conducted its first public land coal lease sale in over a decade within the Powder River Basin. The auction attracted only a single bidder, the Navajo Transitional Energy Company, which offered a mere $186,000 for a tract containing an estimated 167 million tons of coal. This translates to an offer of approximately one-tenth of one cent per ton, a stark contrast to sales in 2012 that commanded over $1 per ton. Citing a failure to achieve fair market value as required by the Mineral Leasing Act, federal authorities rejected the bid. Days later, the Interior Department preemptively canceled another scheduled sale in the Powder River Basin for 441 million tons of coal. A third sale in southwestern Utah also garnered only one low bid, which was similarly rejected.

The broader energy sector has also signaled its move away from coal. Shortly after the administration’s announcement of taxpayer subsidies for coal, PacifiCorp, the largest grid operator in the Western U.S., reaffirmed its commitment to converting its Naughton coal plant in Wyoming to run on natural gas. Idaho Power, another major utility, even proposed a rate decrease for its customers after realizing cost savings from decommissioning a unit at a Nevada coal plant. Crucially, no utility across the country has seriously proposed constructing new coal-fired power plants, primarily because coal is now widely considered an obsolete, economically uncompetitive, and environmentally detrimental technology in the modern energy landscape. The global trend towards cleaner energy sources, coupled with the plummeting costs of renewables and abundant natural gas, has made new coal investment largely untenable.

The administration’s consistent encouragement of increased oil and gas drilling, often encapsulated by the "Drill, Baby, Drill" slogan, has also faced significant market resistance. Despite the Bureau of Land Management issuing drilling permits at an accelerated pace—2,660 permits on public lands during the first six months of the Trump administration, averaging 524 per month, significantly surpassing Biden’s peak of 317 per month in 2023—actual drilling activity has remained largely stagnant. Drill rig counts, a key indicator of industry enthusiasm and future production levels for crude oil and natural gas, have not only failed to increase but have actually fallen significantly compared to a year prior to Trump’s initial election. This downturn is partly attributable to sustained low global oil prices, a phenomenon that Trump himself has at times advocated for, even reportedly pressuring Saudi Arabia and other OPEC members to increase their output. Additionally, the administration’s disorderly trade wars and tariffs on critical materials like steel and aluminum have raised operational costs for drillers, further dampening investment and activity.

The sentiment within the industry itself reflects this pessimistic outlook. A recent anonymous survey of oil and gas executives conducted by the Federal Reserve Bank of Dallas revealed a pervasive lack of optimism. Most executives indicated that the administration’s regulatory rollbacks and reductions in federal royalties would only marginally lower their "break-even" costs and would not lead to an appreciable increase in production. One executive candidly stated, "It’s going to be a bleak three-plus years for the oilpatch," while another noted a drastic reduction in their drilling budget post-election, referring to it as "Liberation Day." A particularly stark observation declared, "We have begun the twilight of shale. Several multibillion-dollar firms that have previously been U.S.-onshore-only are making investments in foreign countries and riskier (waterborne) geologies." This executive also raised critical questions about the eventual fate of hundreds of thousands of abandoned and orphaned wells, emphasizing, "Society will not treat us kindly unless we do our part to clean up after we are gone." These insights underscore a growing realization within the industry that the shale boom, while transformative, is reaching maturity, and future growth may lie elsewhere, with significant environmental liabilities remaining on U.S. soil.

Further illustrating the disconnect between political will and market realities, the Trump administration recently moved to reopen 1.56 million acres of the Arctic National Wildlife Refuge’s coastal plain to oil and gas leasing, mirroring a similar action at the outset of his first term in 2017. The refuge, a pristine wilderness renowned for its ecological significance and sensitive wildlife habitats, has long been a flashpoint in the national debate over resource extraction versus conservation. However, past attempts to lease these lands have met with little industry interest. The first lease sale in the refuge, held in 2021 just before President Biden’s inauguration, attracted only minimal bids, none from major oil companies, with most leases going to an Alaska state agency. A subsequent auction in January 2025 drew no bids whatsoever, unequivocally demonstrating the industry’s disinterest in these remote and costly ventures.

Ultimately, the trajectory of U.S. energy production is driven by a complex interplay of market dynamics, technological innovation, global commodity prices, and investor confidence, rather than solely by federal policy or political rhetoric. Just as President Biden’s increased regulations on oil and gas drilling did not significantly curtail production due to strong market demand, the Trump administration’s aggressive deregulation and hostility toward renewable energy are unlikely to halt the fundamental momentum of solar and wind power. Firms continue to bring utility-scale renewable projects online at a rapid pace and secure financing for new proposals, even in the absence of federal incentives, driven by their inherent economic competitiveness and growing demand for clean energy. While federal policies can certainly influence the profitability of energy companies, mitigate environmental impacts, or shape the pace of certain developments, they are but one factor among many. True energy dominance or independence, particularly in a dynamic global market, cannot simply be willed or forced into existence through political decrees; it emerges from a strategic alignment with economic realities and technological progress.